The storage industry giant Western Digital, which has long been well-known for its solid-state and hard disk drives, has formally split off its NAND flash memory division, thereby ceasing to be directly involved in the manufacturing and distribution of SSDs. The PC gaming community has been greatly touched by Western Digital’s innovative and high-quality legacy following its retirement from the market.

After some time of planning, this transfer was finally completed last week. Western Digital is now only focused on hard disk drive technology because the SSD section was completely spun off into SanDisk. The business, which has been a household name in the HDD and SSD industries and competes with industry titans like Samsung and Crucial, is at a turning point with this separation.

This revelation is a bittersweet time for PC gamers who have been drawn to SSDs because of their greater speed and performance. The WD Black SN850X is now the greatest SSD for gaming, and Western Digital has manufactured some of the most well-liked SSDs in the gaming world. The industry has grown to rely on the recognizable WD_Black design, and its possible omission from upcoming goods signals the end of an era.

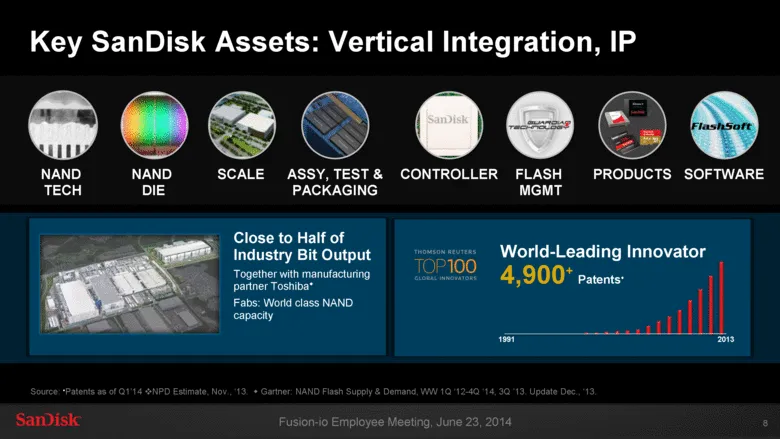

It is crucial to remember that this company reorganization does not necessarily mean that SSD production will cease. SanDisk, which has been in charge of operations pertaining to flash memory since last year, will keep producing and marketing SSDs. In order to give the industry enough time to get ready for the shift, the foundation for this transition was established in October 2023.

It is anticipated that SSD manufacture would not be significantly disrupted. Under SanDisk’s leadership, Western Digital’s use of Kioxia’s (formerly Toshiba) manufacturing facilities for NAND fabrication could continue.

As an alternative, SanDisk can collaborate with other producers, like Samsung, to fulfill demand.

The disappearance of the recognizable WD branding on upcoming SSD goods is probably going to be the most obvious shift for customers. Given that merely substituting “SD” for “WD” could cause confusion with SD cards found in cameras and portable electronics, the industry will be closely monitoring SanDisk’s future branding strategies for its SSDs.

Western Digital, meanwhile, is concentrating on the changing HDD market potential. “HDD exabyte shipments are expected to increase as AI accelerates and impacts industries around the world, as well as as companies generate and store more data,” stated CEO Irving Tan. He also notes that a large portion of the data that cloud service providers hold, including video, AI data lakes, native cloud application data, and machine learning data, is saved on HDDs.

Delivering HAMR when it reaches economic crossover is the short-term goal, according to Tan. With their commitment, the potential uses of our technologies in the future are genuinely limitless. “Beyond HDD, our teams are investigating new growth opportunities that capitalize on our core capabilities in magnetics and materials science.”